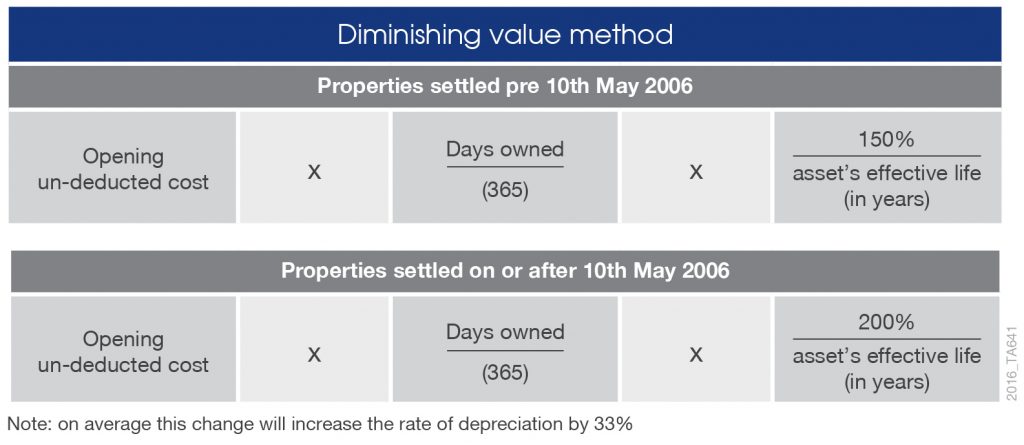

Diminishing value method formula

Examples of Prime Cost and Diminishing Value Depreciation Method. Mabry et al 274 Ga.

Diminishing Balance Depreciation Method Explanation Formula And Example Wikiaccounting

This would be applicable for both Straight Line and Diminishing Value depreciation.

. Depreciation 462500 x 10100 46250. In this video we use the diminishing value method to calculate depreciation. Depreciation 374625 x 10100 x 312 9366.

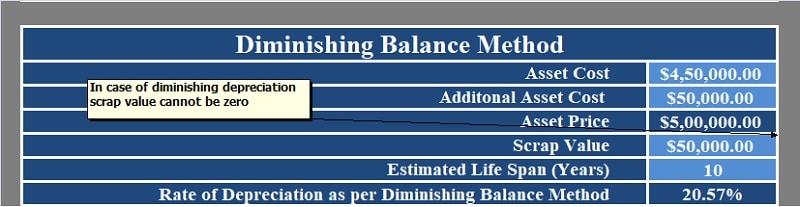

If the asset cost 80000 and has. The following formula is used for the diminishing value method. Diminishing Balance Method Example.

Calculation of loss on sale of machinery. A company has brought a car that values INR 500000 and the useful life of the car as expected by the buyers is ten years. Depreciation 416250 x 10100 41625.

Depreciation - 10500 calculated from 1306 300606 - But only 4 months in. Thus the value of the equipment is diminished by Rs 10000 and becomes Rs 90000. You might need this in your mathematics class when youre looking at geometric s.

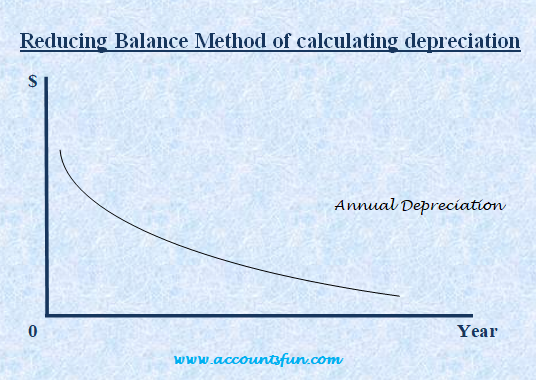

Here are a few important factors that you should consider about these two methods. 000 over 100000 miles. The diminishing balance depreciation method is one of the three depreciation methods mentioned in IAS 16.

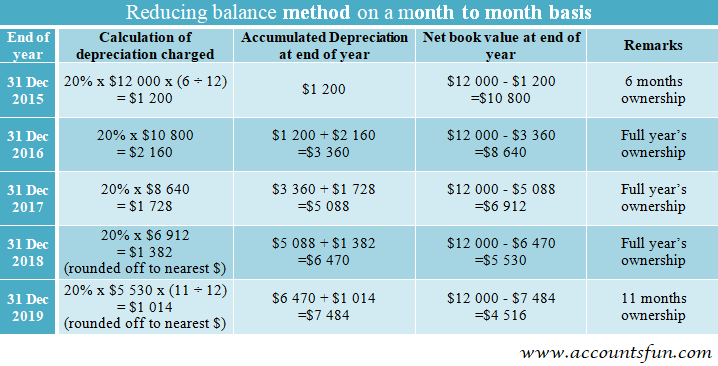

As it uses the reducing. Diminishing Balance Method The various methods of depreciation are based on a formula. Diminishing value method.

Then you apply the damage and mileage multipliers. Book Value Diminishing Method. The 17c formula was developed by State Farm when the Georgia Supreme Court in the matter of State Farm Mutual Automobile Insurance Company v.

Assets cost days held365 Depreciation rate. The diminishing balance method is a. When using this method assets do not depreciate by an equal.

The diminishing balance method is a method of calculating the depreciation expense of an asset for each accounting period. And the residual value is. Another common method of depreciation is the diminishing value method.

To determine the diminished value you multiply the vehicle value by the 10 cap. Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense. 2000 - 500 x 30 percent 450.

For the second year the depreciation charge will be made on the diminished value ie. Written down value method or reducing installment method does not suit the case of. November 29 2020 - 132 am.

Diminishing Balance Depreciation is the method of depreciating a fixed percentage on the book value of the asset each accounting year until it reaches the scrap value. This kind of depreciation method is said to be highly charged in.

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Straight Line Method Vs Diminishing Balance Method Depreciation Calculation Examples Youtube

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Written Down Value Method Of Depreciation Calculation

Written Down Value Method Of Depreciation Calculation

Depreciation Formula Calculate Depreciation Expense

How To Calculate Depreciation Using The Reducing Balance Method Diminishing Balance Method Youtube

Diminishing Value Vs The Prime Cost Method By Mortgage House

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

How To Calculate Depreciation Using The Reducing Balance Method Diminishing Balance Method Youtube

Declining Balance Depreciation Calculator

Written Down Value Method Of Depreciation Calculation

Straight Line Vs Reducing Balance Depreciation Youtube

What Is Diminishing Balance Depreciation Definition Formula Accounting Entries Exceldatapro

Depreciation Formula Examples With Excel Template

Depreciation Diminishing Value Method Youtube